24+ mortgage securitization

Current estimates suggest that there. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

Moderating Effects Of Bank Ownership On The Relationship Between Securitization Uptake And Financial Performance Of Commercial Banks In Kenya Document Gale Academic Onefile

Free Shipping on Qualified Orders.

. Smith as the borrowers and. Ad Buy an introduction to mortgages and mortgage backed securities at Amazon. Web Certified Mortgage Securitization Auditors LLC Los Angeles California.

Web They can sell your mortgage note to someone else in the form of a bond. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Smith and Marie B.

But any type of asset with a stable cash flow can in principle be structured. Banks and other financial. Save Real Money Today.

This can continue for additional steps. Web Sue for Mortgage Fraud. Web From robo-signings to illegal foreclosures the mortgage industry has done everything they can to stick their grubby fingers in the pockets of hardworking individuals.

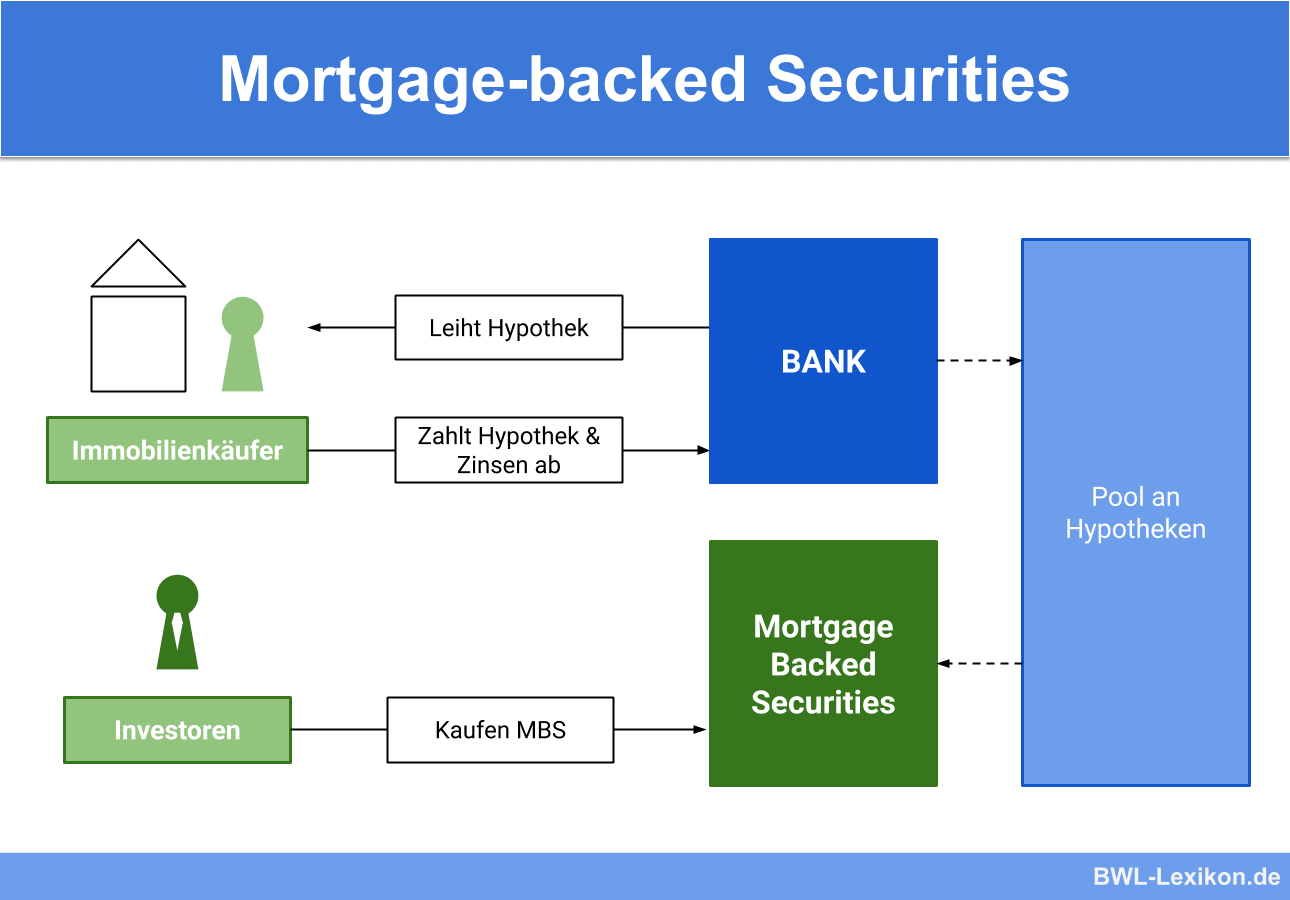

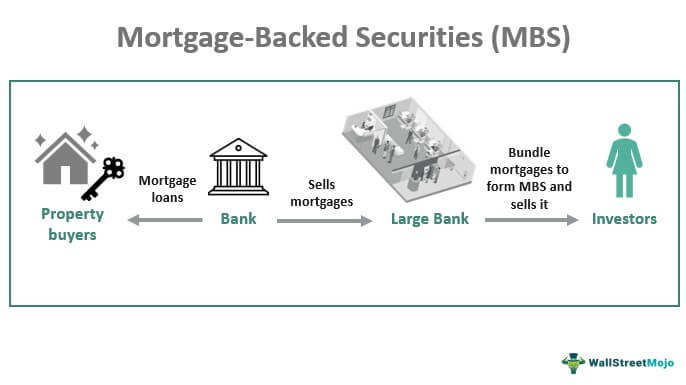

Sold and traded on the secondary markets. Nations Leading Experts on Mortgage Securitization. Web Securitization is the process of turning assets like credit card debt auto loans commercial mortgages and residential mortgages into a portfolio of.

The promissory note names Joseph A. Web Securitization turns illiquid assets of individual mortgage loans into marketable securities that can be bought. County Judges Audited Against MERS Inc.

Hopefully that investor is willing to pay something like 102000 for the right to collect interest on your. Web to your mortgage to back other securities they issue. Web The loan that is the subject of this securitization audit was granted on March 22 2007.

5689 likes 1 talking about this 2 were here. Web Securitization is a process in which certain assets such as mortgages debts loans or other legally binding agreements and contracts are bundled. Web Securitization is a risk management tool used to reduce the idiosyncratic risk associated with the default of individual assets.

Web A security comprised of mortgages is called a mortgage-backed security while other securities are referred to as asset-backed securities. Web We have spent over 19 years carrying out extensive research into how and why banks across the globe carry out securitization and the simple truth answer is as follows. Web Securitization was initially used to finance simple self-liquidating assets such as mortgages.

In effect the eventual buyers of the mortgagethe parties that provide the fundingcan.

Mortgage Securitization Econbrowser

The Social Structure Of The Mortgage Securitization Industry Download Scientific Diagram

Understanding Securitisation Asset Backed Securities Abs

Moderating Effects Of Bank Ownership On The Relationship Between Securitization Uptake And Financial Performance Of Commercial Banks In Kenya Document Gale Academic Onefile

Biggest Rally In Over A Decade After Cpi Overdelivers

Sec Filing Jpmorgan Chase Co

Mortgage Backed Security Mbs Definition Example

Investordaypresentation

Economist S View The Role Of Securitization In Mortgage Lending

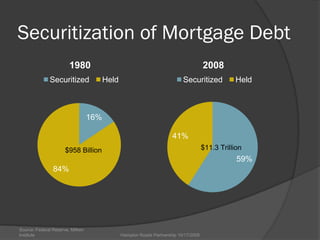

Economic Crisis Of 2008

Securitization Subprime Mortgage Credit Frm Part 2 2023 Book 2 Chapters 17 18 Youtube

Securitization And Mortgage Backed Securities Youtube

Mortgage Securitization Econbrowser

Pdf The Role Of Securitization In Mortgage Lending

Securitization And Mortgage Backed Securities Youtube

Lmrk Ex11 99 Htm

How Re Performing Loans Rpl Helped The Housing Market